CONNELLWA.COM Staff

January 29, 2026

CONNELL, WA -

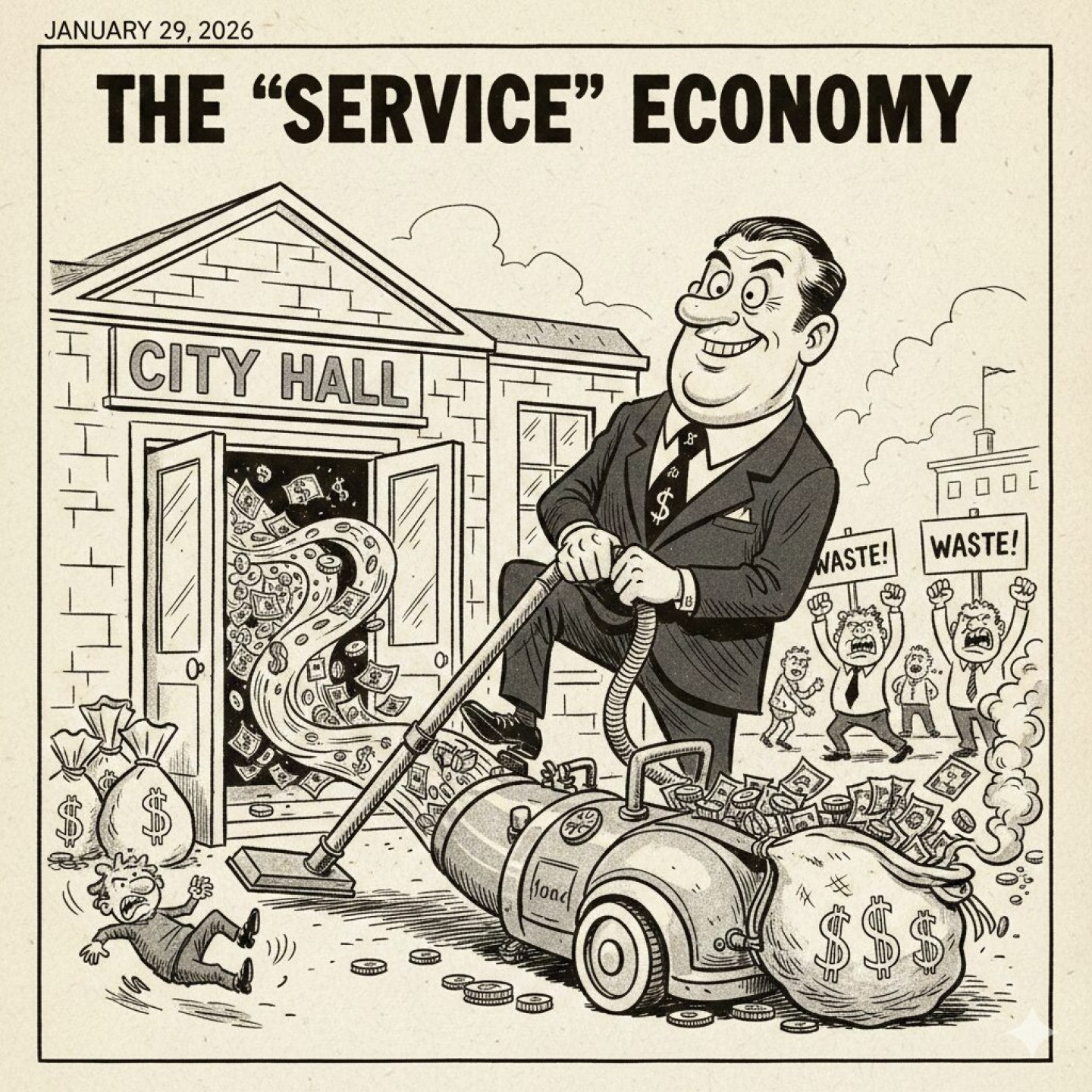

As the new city council and mayor settle in, a nagging issue at hand is the state-required Comprehensive Plan update. The last time an update of this kind occurred, the bulk of the task was handled by outside consultants, which is not uncommon or always unwarranted, but usually comes with a hefty price tag. With any type of "professional service" and even those as minor or trivial as copyright/trademark registration or the purchase of website domains, one can always find service provider experts waiting to take some or all of the burden.

According to the Washington RCWs concerned with comprehensive plans, community input is blatantly required, encouraged, and emphasized in the most obvious terms an RCW can muster. The current comprehensive plan is thoroughly padded but often reads like a copy-and-paste of an early Wikipedia post, gloating about the "recent completion of Highway 395", a landmark event that occurred nearly 40 years ago at the time of this writing. We couldn't find a single person serving in the local Chamber of Commerce, Connell Community Club, or school board who received any notice or request for input to the comprehensive plan at any time in the last 10 years.

Anyone who had the opportunity to review the document certainly would have detected all the language present, outlining plans to effectively turn Connell into another King City (truck stop). If the adult bookstore and cabaret-licensed establishment provisions weren't enough, simply follow the trail of unnecessary Light Industrial rezoning operations that were sold in council meetings as "little cleanups to the codes". All of the code adjustments were made to the tune of a few thousand dollars, and to what benefit? It was hard to tell that growth was the goal when Ace Hardware was nearly run off because they were told they needed to buy an equivalent acreage allotment to provide a place for the field mice they were evicting from the development grounds. The city and consultants were reading too far into a Department of Ecology document that was, in all respects, a "best practices" message. There isn't enough land in Washington to do that in every instance of a new building project. Even if the feds decided to start giving up some property, the tribes aren't giving up any land.

AHBL, a large city planning and associated service provider, was contracted by the city at the time of the last update. The firm and City Hall took harsh criticism from locals during the last administration for a variety of issues, usually associated with cost. In 2024, the city council voted to fire AHBL, but the former city administrator (Koch) and previous mayor (Barrow) doubled down on their position, electing to keep the firm under hire. Following the vote, the city administrator was furnished with a list of over 1,200 similar firms in Washington and a dozen within 50 miles as alternatives. At the next council meeting, she claimed she could only find 2 or 3 competing companies, but they either didn't want the job or were too expensive.

The responsibility falls on the council if the mayor won't provide accountability. AHBL is just a service provider, providing services with stated budgets and estimates. Though we've been unable to locate a detailed itemized invoice in most cases surrounding questionable costs, the firm tells the client what they're going to do and bills for it legitimately. In interviews conducted with some of their other customers, we received quotes like "they do excellent work", "always on time", and "efficient". However, they are obviously too large a firm for Connell's interests, as a city of this size can't afford upwards of $50,000 for "services" in most months. Whereas, in a city the size of Pasco, being totally fine with paying assistants to the assistants of a major office six-figure salaries, sure, hire the consultants to do the thing. In a services quote document attained from the city, AHBL's price tag on the new comprehensive plan update is in the neighborhood of $60,000. Though this is supposed to be paid for by a grant, the price is roughly 5 times the cost of the last update. Connell may be up an Ace Hardware and a Metro Mart, but we're down a Lamb Weston, and the building permits for new houses haven't been keeping up with our nearest neighbors -- how is the exact same exercise in a document revision with public comment now 5 times what it cost a few years ago?

What Is Not Required (But Often Claimed)

The following are not minimum legal requirements unless triggered by other facts:

❌ Hiring a consultant

❌ Rewriting the entire plan

❌ Adopting every optional Commerce model policy

❌ County approval of the city’s plan

❌ A “comprehensive rewrite” if targeted amendments achieve compliance

Bottom-Line Compliance Test for Connell

Connell is compliant only if all of the following are true by December 31, 2026:

✔ City Legislative action taken

✔ Public participation program followed

✔ 60-day Commerce notice completed

✔ Mandatory elements updated and consistent

✔ Development regulations aligned

✔ Countywide policies honored

The Origins of Contemporary City Planning

The origins of modern planning can be traced to the City Beautiful movement of the early 20th century, an era focused on the physical development of cities, famously captured in Daniel Burnham’s 1909 plan for Chicago. This period was followed by the landmark 1926 Supreme Court decision in Village of Euclid v. Ambler Realty, which established the constitutionality of zoning and provided the legal bedrock for the comprehensive plans we use today.

For decades following World War II, the field was dominated by a top-down, expert-led model articulated by thinkers like T.J. Kent. This rational planning process positioned city councils as the primary client and called for limited public participation. However, by the 1990s, a significant shift occurred. Influenced by the rise of advocacy planning, a new approach centered on visions and values emerged as a direct reaction to the perceived rigidity of the expert-led model. This modern paradigm emphasizes robust community participation as an essential component for creating plans that reflect a community's unique identity and aspirations.

Washington’s approach to growth planning began in 1990, when the Legislature adopted the Growth Management Act (GMA). Lawmakers were responding to a growing concern that uncoordinated development was straining infrastructure, degrading natural resources, and undermining long-term economic stability. The GMA established a framework requiring local governments to plan deliberately, using data, public input, and long-range coordination.

At the center of that framework is the comprehensive plan—a legally binding, 20-year policy document that guides nearly every land-use and infrastructure decision a local government makes.

A Plan Built by the Community

Comprehensive plans are not meant to be written behind closed doors. State law requires early and continuous public participation, ensuring that residents, property owners, businesses, and community organizations have meaningful opportunities to shape local priorities.

Franklin County’s original comprehensive plan, adopted in the mid-1990s, illustrates how this process works. As the county prepared for growth driven by agriculture, food processing, and regional employment centers like the Tri-Cities, officials gathered public input through countywide questionnaires, targeted interviews with city leaders, and a series of public meetings held across the county.

That outreach helped identify local concerns that still resonate today: housing availability, infrastructure capacity, protection of agricultural land, and the desire to maintain rural character while accommodating growth. Those values became the foundation of the county’s planning policies.

What a Comprehensive Plan Must Include

Under the Growth Management Act, every comprehensive plan must include a coordinated set of required elements. Each element addresses a different aspect of community life, but they are legally required to work together.

At a minimum, plans must include:

- Land Use – Identifies where residential, commercial, industrial, and open space uses will be located and at what intensity.

- Housing – Plans for sufficient housing to serve all income levels and household types.

- Capital Facilities – Identifies public facilities, such as parks, buildings, and roads, and explains how they will be funded.

- Utilities – Addresses water, sewer, stormwater, and other essential services.

- Transportation – Coordinates roads, transit, walking, and biking systems with land-use decisions.

- Rural Development (counties) – Protects rural character while allowing limited development.

- Climate Change and Resiliency – Prepares communities to reduce emissions and respond to climate-related risks.

These elements are not optional. Failure to keep them consistent can expose a city or county to legal challenges before the Growth Management Hearings Board.

Land Use: The Map That Guides Everything

The Land Use element sets the overall direction for growth. It is typically illustrated through a future land-use map that shows where housing, commerce, industry, and public facilities are expected to locate over the next two decades.

In Franklin County, land-use planning must balance urban growth with the protection of agricultural lands that form the backbone of the local economy. The GMA requires counties to conserve resource lands while directing most development to designated urban growth areas.

State law also requires land-use plans to address issues such as groundwater protection, wildfire risk, and the siting of essential public facilities—issues of particular importance in eastern Washington’s arid climate.

Housing: Planning for a Growing and Changing Population

Housing has become one of the most closely watched elements of comprehensive plans statewide. Washington law now requires jurisdictions to plan for a full range of housing types and income levels, including emergency housing, workforce housing, and market-rate development.

Recent changes to state law require local governments to identify barriers to housing production and to address past policies that contributed to exclusion or displacement. For growing communities in Franklin County, this means planning not only for population growth, but for changing household sizes, workforce needs, and affordability challenges tied to regional job growth.

Infrastructure: Paying for Growth

The Capital Facilities and Utilities elements answer a critical question: Can the community afford the growth it is planning for?

Under the GMA, local governments cannot plan for growth unless they can demonstrate that public services—such as water, sewer, roads, and parks—will be available when needed. Just as importantly, they must identify realistic funding sources, whether through impact fees, utility rates, grants, or local taxes.

This requirement directly ties long-range planning to local budgets and capital improvement programs.

Transportation: More Than Just Roads

Transportation planning in Washington has evolved well beyond vehicle traffic. Comprehensive plans must now address multimodal transportation, including walking, biking, freight, and transit.

For Franklin County communities, this includes coordinating local transportation plans with state highways, agricultural freight routes, and regional transit systems, while also improving safety and access for non-drivers.

Climate Resilience: A New Planning Requirement

In 2023, Washington added the Climate Change and Resiliency element as a mandatory part of comprehensive plans. This reflects growing concern about wildfire, heat, drought, and infrastructure vulnerability.

Local governments must now include policies aimed at reducing greenhouse gas emissions and improving the community’s ability to prepare for and recover from climate-related hazards—an issue with clear relevance in eastern Washington.

Keeping Plans Current

Comprehensive plans are not static documents. The GMA requires periodic updates—currently every 10 years—to ensure plans reflect updated population forecasts, new state laws, and evolving community priorities.

Franklin County has gone through multiple update cycles since its original adoption, adjusting to legislative changes and growth patterns while maintaining consistency with state planning goals.

From Vision to Law

Perhaps the most important feature of a comprehensive plan is its legal authority. Zoning codes, development regulations, and capital budgets must be consistent with the adopted plan.

That means the plan is not just aspirational—it is enforceable. If a land-use designation allows mixed-use development, zoning must permit it. If an area is planned for rural residential use, industrial development cannot be approved there.

Why It Matters

Comprehensive plans are the backbone of Washington’s growth-management system. They translate community values into policy, coordinate growth with infrastructure, protect natural and agricultural resources, and provide predictability for residents and investors alike.

Most importantly, they work best when the public is engaged. Participation—whether through surveys, public meetings, or written comments—directly shapes how communities grow and adapt over time.

Sources

- Washington State Growth Management Act (RCW 36.70A)

- Washington State Department of Commerce – Growth Management Planning

- Franklin County Comprehensive Plan (original adoption and subsequent updates)

- Washington State Office of Financial Management population forecasting guidance

- Washington State Department of Commerce: Growth Management Act Overview

- Municipal Research and Services Center (MRSC): Comprehensive Planning Guide

- Revised Code of Washington (RCW): Chapter 36.70A RCW - Growth Management

- Franklin County Planning & Building: Local Comprehensive Plan Updates